Cash balance pension plan calculator

Interest crediting rate is 5. The cash balance plan calculator amount is an estimate only for setting up the plan in the first year.

Cash Balance Plans Erisa

Like a traditional pension a cash balance plan provides workers with the option of a lifetime annuity.

. However choosing a pension plan option that only. The Cash Balance formula is of compensation and the Profit Sharing formula is of compensation where compensation is limited to the IRS maximum. A cash balance plan is a twist on the traditional pension plan.

A guaranteed minimum investment return or. Your maximum contribution to a Cash Balance. Beginning of year account balance is 20000.

You can find Deloittes pension plan in there and they included a table of average Cash balances by age and years of service in the plan. The Online calculator is designed for a company without employees other than the owners and generates a proposal for a Cash Balance and 401k Plan Proposal in less than 5 minutes. 42 rows 2022 Contribution Limits Table.

In a typical cash balance plan a participants account is credited each year with a pay credit such as 5 percent of compensation from his or her employer and an interest credit either a. Cash balance plans work in much the same way as defined contribution schemes but they also include. For the purposes of this.

In the US today very rarely is the term DC. A cash balance pension plan is a pension plan under which an employer credits a participants account with a set percentage of his or her yearly. The maximum contribution for the profit sharing contribution may be limited due to certain deduction limits.

Choosing an option that guarantees a spouse pension benefits after your death means extra security but also lower monthly benefits. Here is the 5 step process. Use this calculator to determine your maximum contribution toward your Cash Balance Plan for 2016.

Compensation typically the W2 is 100000. B eg inC as hl c Ttm ou f y rb dp. Please do not contribute to an already existing plan using our cash balance plan.

The cash balance formula uses three variables to calculate your benefit. Cash Balance Pension Plan. The amount of money an employee receives can be determined.

The Cash Balance Plan is assumed to be. For more information or to do calculations involving each of them please visit the 401 k Calculator IRA Calculator or Roth IRA Calculator. Pay credit is set at 4 of.

A cash balance pension plan can be tailored to individual employees and offers a set target amount of money upon the employees retirement. For people with 1-5 years the average cash balances. A cash balance pension plan is a defined benefit plan that offers employees a stated amount at retirement.

The most common uses for the Present Value of Annuity Calculator include calculating the cash value of a court settlement retirement funding needs or loan payments. Married filing jointly or head of household. In addition the estimate for the.

Contributions are typically charged as a. How are benefits determined under the cash balance formula.

One And One Makes Five Calculating The Minimum Required Contribution

Retirement Withdrawal Calculator For Excel

Maximum Contribution Calculator Cash Balance Design

Cash Balance Pension Plans Explained Rules Formula Example Video

Cash Balance Retirement Plan Guide

Cash Balance Conversions

What Is A Cash Balance Plan Retirement Savings Beyond A 401 K

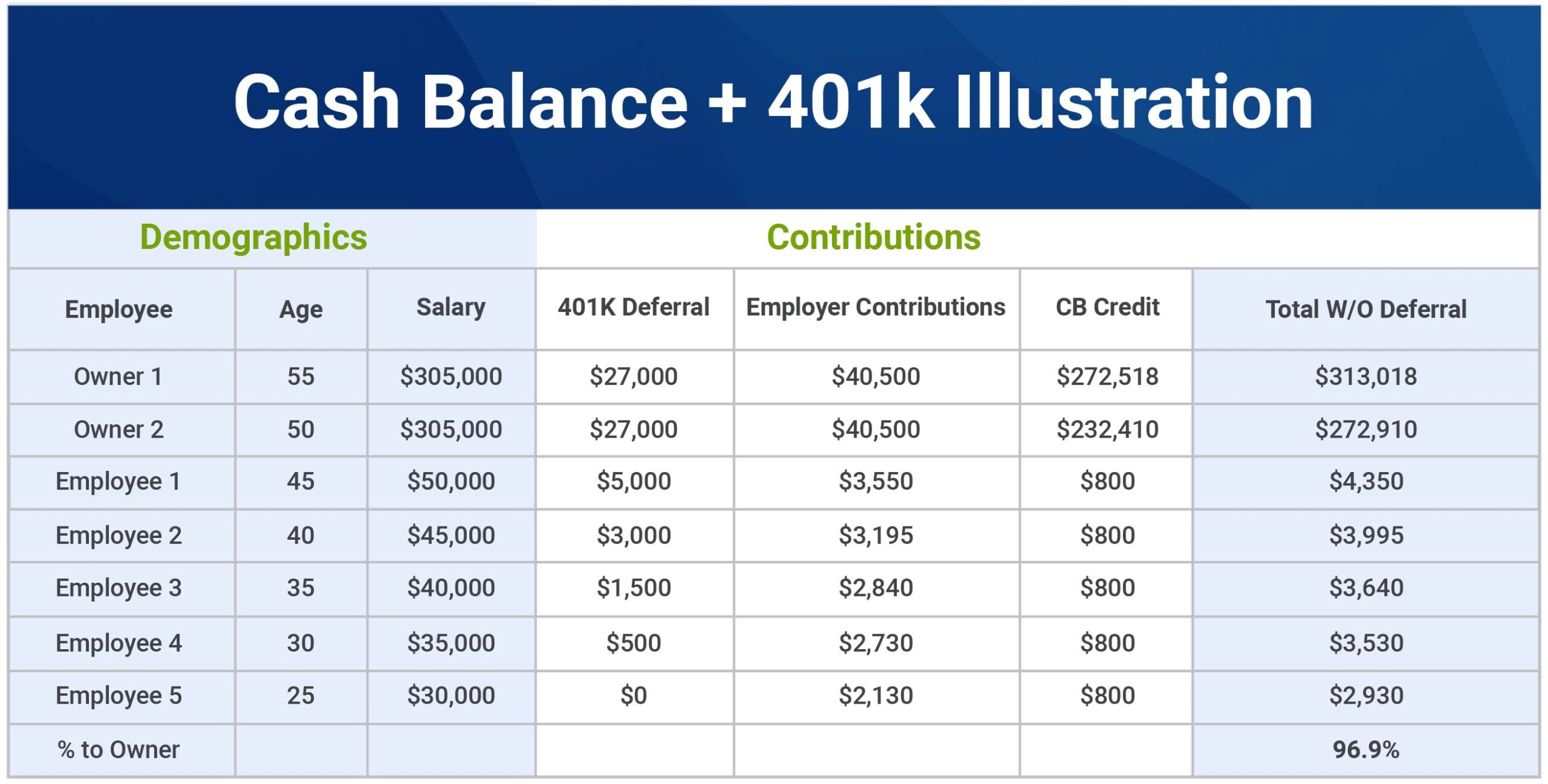

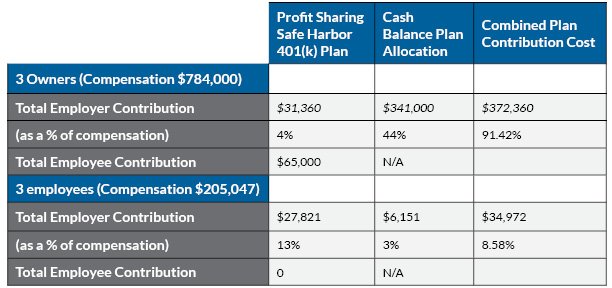

Beyond The 401 K Cash Balance Plans For High Earning Small Business Owners Chancellor Wealth

Cash Balance Plans Accelerate Savings Maximize Tax Deductions July Services

Cash Balance Plan Example Calculation The Simple Process Emparion

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

Projected Benefit Obligation Pbo Definition

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Cash Balance July Services

:max_bytes(150000):strip_icc()/Ford_Pension-266748d9d69f40208878c0917b463882.png)

Projected Benefit Obligation Pbo Definition

Cash Balance Plan Formula Easy 5 Step Process Video

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

Projected Benefit Obligation Pbo Definition

Cash Balance Plans The Retirement Strategy That Can Drive Big Tax Savings For Small Business Owners Rkl Llp