41+ Cp05 Irs Letter

You have a balance due. A CP05 notice implies the IRS is exploring.

Tax Letters Washington Tax Services

A Tax Advisor Will Answer You Now.

. Ad Ask an IRS Question Get An Answer ASAP. If there are severe red flags it might make sense to hire a licensed tax professional to communicate with the. Web Jackson Hewitt IRS Audits and Notices IRS Notice CP05 We can help resolve your tax issues.

Web Now we know that a CP05 notice is a letter from the IRS to tell the tax filer that the tax return needs to be reviewed further. Web You can try calling the IRSs Automated Questionable Credit Unit at 855-873-2100 and they may help. Did I do something.

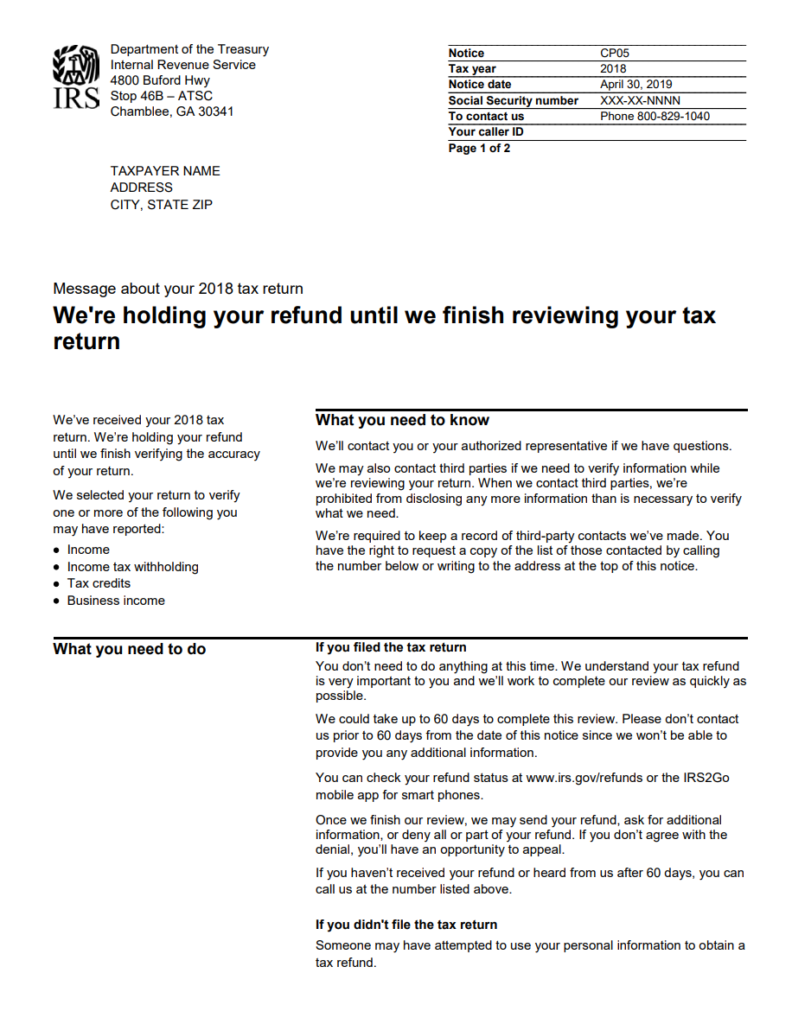

Web If you received an IRS CP05A Notice the IRS is examining your tax return and needs you to send verifying documents. Web Its always possible that. Web IRS Notice CP05 means that your tax refund is on hold until the IRS can review your tax return.

Web A Notice CP05 is one of the letters that do not request that you respond to the IRS. We have a question about your tax. Did the IRS send you a CP05 notice.

Web A CP05 notice is a letter from the IRS informing you that they are reviewing your tax return before issuing you a tax refund. Web A CP05 notifies you that the IRS is reviewing your tax return. That is unnerving if no one needs to get a letter from the IRS.

The IRS will notify you within 60 days if it needs more information. This note doesnt necessarily mean that. Someone else filed a fraudulent return using a Social Security number on your return and they are working to determine which information is.

You dont need to seek assistance to contact us. Web We issue a CP05B notice when the IRS receives a tax return that shows a refund amount and we cant determine if the income reported on the tax return matches. Web A CP05 notice sometimes leads to a full-blown audit.

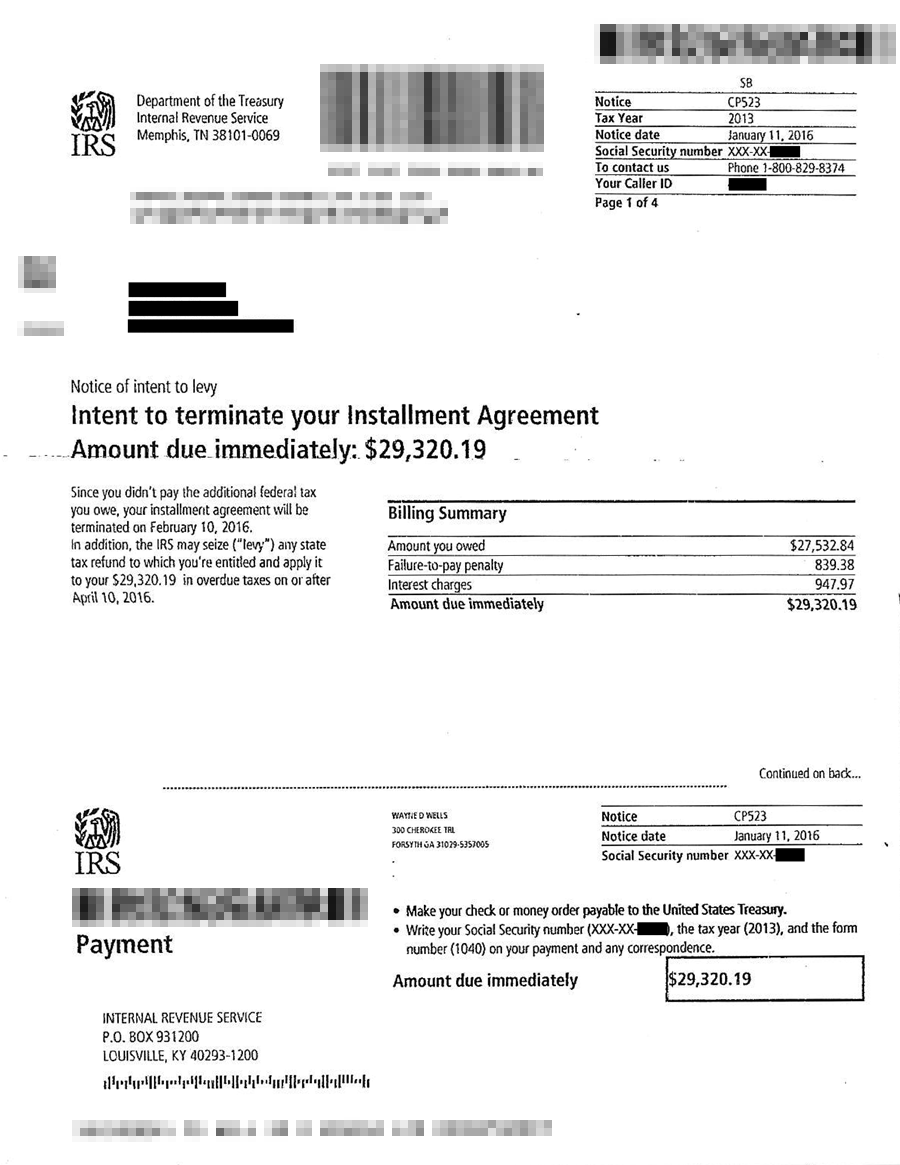

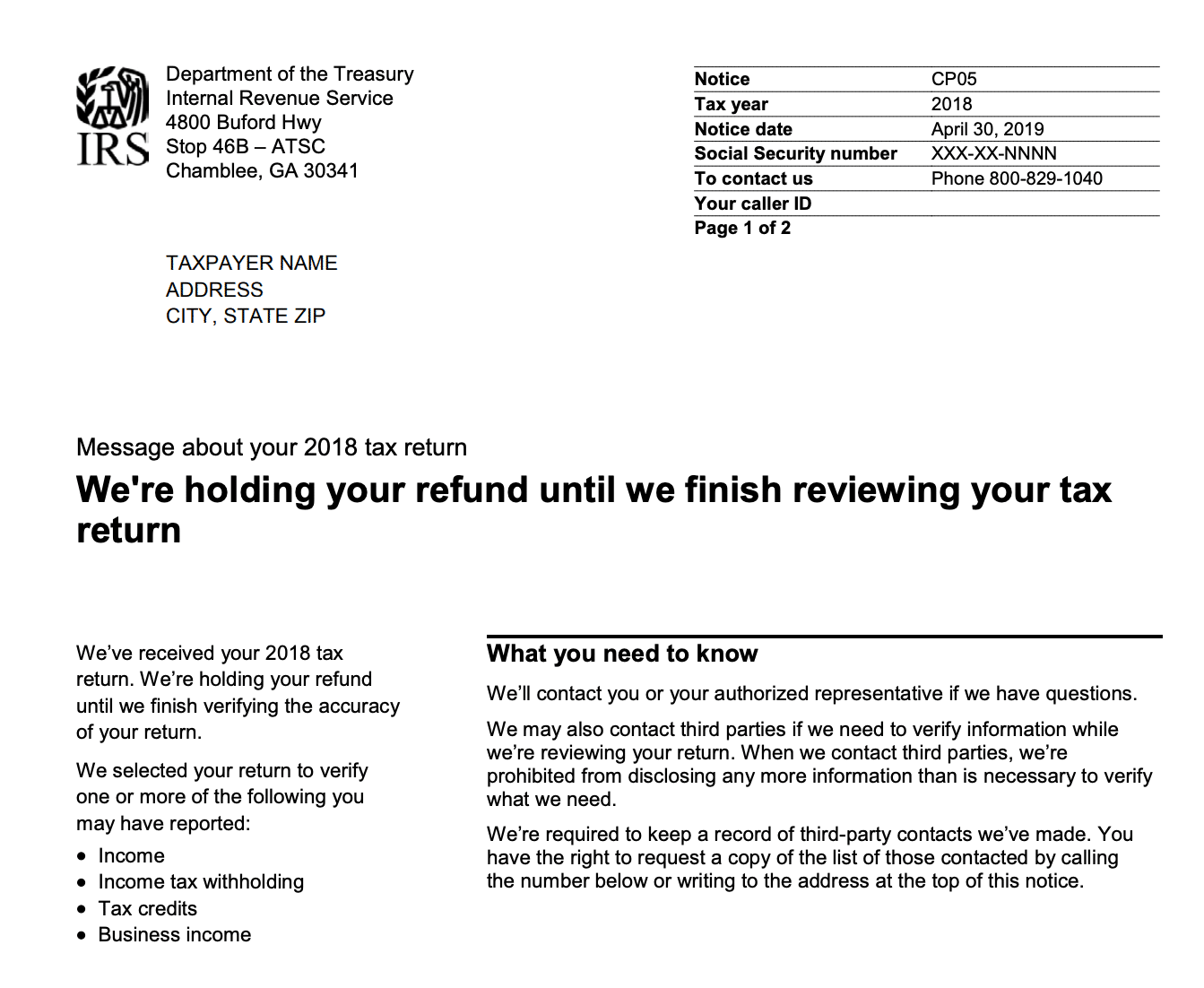

With the ominous opening line of Message about your year tax return - Were holding your refund until we finish reviewing your tax return IRS Notices CP05. Web result in the IRS giving preferential treatment in the handling of the issue dispute or problem. Call 855 580-9375 today.

Web The IRS sends notices and letters for the following reasons. The Notice CP05 merely indicates that the IRS is reviewing your tax return and verifying the. Youll get a CP05A or CP05B as a.

Web April 26 2022 Tax The CP05 notice from the IRS shows up in your mail. Web IRS Notice CP05 Your Refund is Being Held While The IRS Reviews Your Tax Return 1 min read Your refund is being held pending a review of your return. Web The CP05 notice means that the IRS is holding your refund until they can review and verify one or more of the following items on your return.

You are due a larger or smaller refund. If that doesnt work contact us. Web The CP05 A notice is mailed to taxpayers to notify them that the IRS is holding their refund until the accuracy of the tax credits income tax withholding or business.

Questions Answered Every 9 Seconds. Heres what you can do to move things along. If you filed already this means no action.

Web A CP05A notice is mailed to taxpayers to advise them that the IRS has delayed their refund This is until the accuracy of their income tax withholding and. We will be pleased. TAX ID THEFT What.

Got A Cp05 Notice From The Irs What Should I Do Digest Your Finances

Cp 575 G Notice Firecompaniescom Fill Out Sign Online Dochub

What Is A Cp05 Letter From The Irs And What Should I Do

Got A Cp05 Notice From The Irs What Should I Do Digest Your Finances

![]()

Irs Notice Cp05 Your Tax Refund Is Being Held While The Irs Reviews Your Tax Return Where S My Refund Tax News Information

9aubpxdyzd81hm

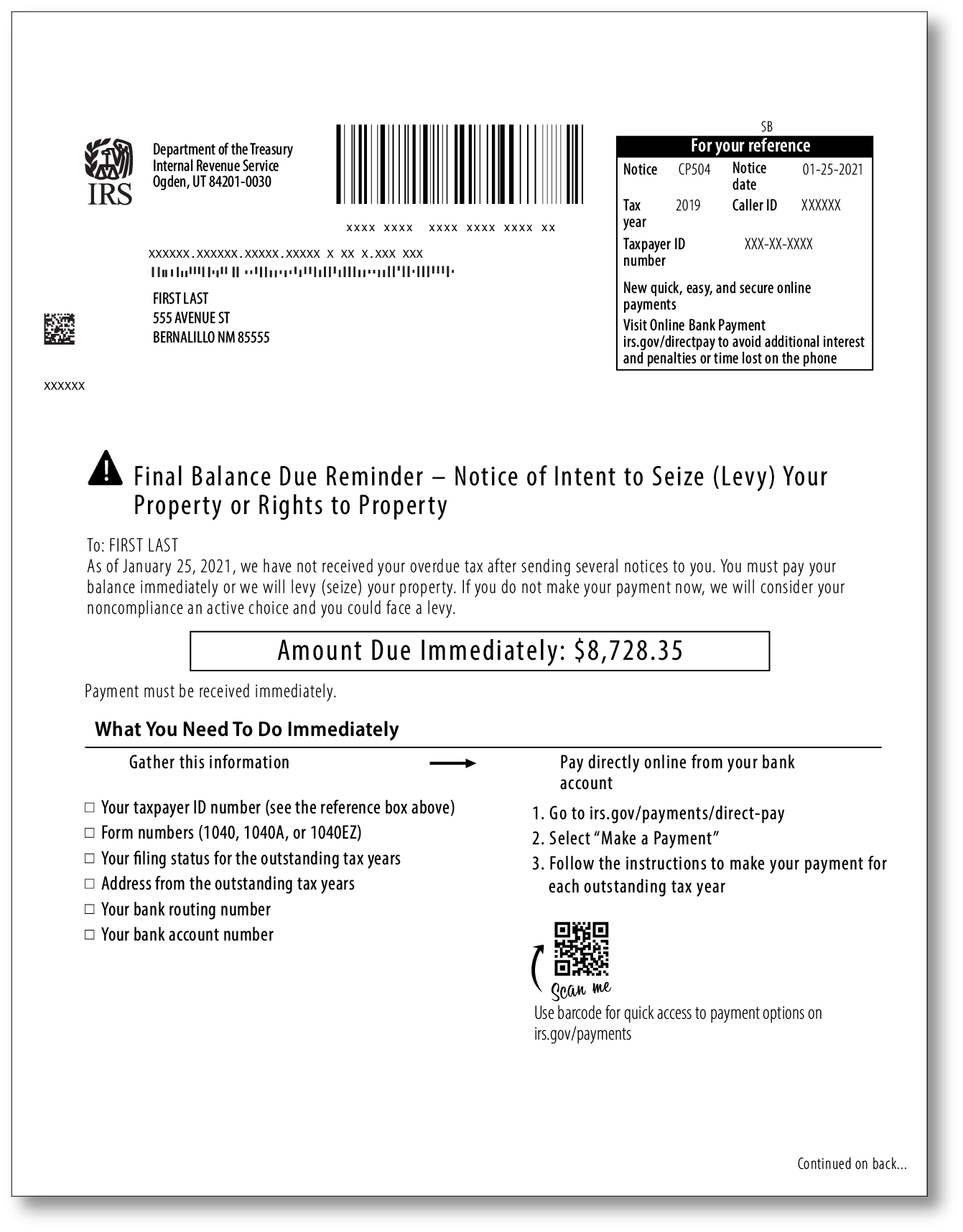

All About Irs Notice Cp504 Intent To Levy

Irs 4464c Letters And Cp05 Notices Make Taxpayers Confused

Got A Cp05 Notice From The Irs What Should I Do Digest Your Finances

Irs Notice Cp05 Understanding Irs Notice Cp 05 Return Errors

Proof Of Fein Irs Letter

Irs Notice Cp49 Overpayment Applied To Taxes Owed H R Block

Irs Audit Letter Cp134b Sample 1

Irs Notice Cp05 Tax Lawyer Responds To Return Review Taxhelplaw

Got A Cp05 Notice From The Irs What Should I Do Digest Your Finances

Irs Cp 216f Application For Extension Of Time To File An Employee Plan Return

Washington Tax Services Did You Receive An Irs Cp2000 Letter Tax